Coronavirus: Moving home allowed as curbs lift on estate agents in England

May 13, 2020

The government has set out plans to restart England's housing market, which has been in deep freeze since the coronavirus lockdown. Estate agents can now open, viewings can be carried out and removal firms and conveyancers can restart operations.

Housing Secretary Robert Jenrick said the changes must be carried out under social distancing and safety rules. It is estimated there are 450,000 buyers and renters with plans on hold.

"Our clear plan will enable people to move home safely, covering each aspect of the sales and letting process, from viewings to removals," Mr Jenrick said. "This critical industry can now safely move forward, and those waiting patiently to move can now do so."

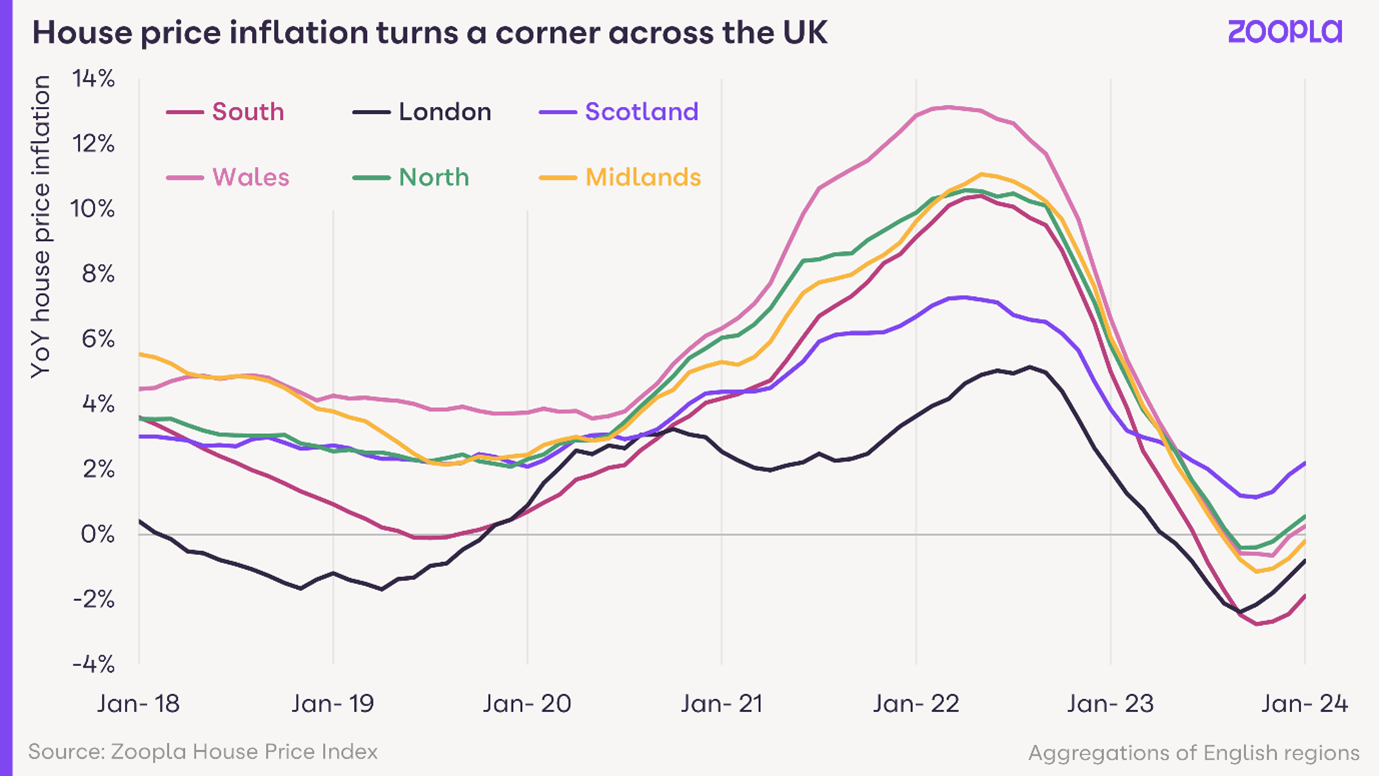

Meanwhile, the property markets in Wales, Scotland and Northern Ireland remain shut. Home viewings are not permitted under lockdown regulations and their land registries are either running a reduced service or are not registering transactions.

Alistair Elliott, chairman and senior partner at estate agents Knight Frank, told the BBC's Today programme the measures were "a major first step. We believe the public will have confidence to re-engage with the housing market," he said.

Jonathan Hopper, chief executive of real estate consultants Garrington Property Finders, said: "Few things are more likely to make people want to move than being cooped up in the same four walls for weeks on end, and property portals have seen traffic increase by up to a fifth."

Personal Finance and Consumer Affairs Analyst Kevin Peachey comments:

This announcement will test the housing sector's hope, and belief, that a wave of pent-up demand amongst buyers and renters is ready to be released. Yet, the reality is that many people's finances are now less secure than they were just a few months ago when they were preparing to move. Expect a lot more haggling over price from both sides if they have yet to have formally agreed what they will pay or accept, especially if getting a mortgage is harder.

Estate agent Savills has already suggested that people who still have money to look for somewhere new, may now be rethinking their priorities. A spare room and good Wi-Fi may suddenly have become more appealing when working from home, and a large garden may be even more of a golden ticket for anyone with children.

Building restart

The government has also outlined other measures to get the house building sector moving, including:

- Allowing builders to agree more flexible working hours with their local council, such as staggering arrival times to ease pressure on public transport

- Enabling local councils and developers to publicise planning applications through social media, instead of having to rely on posters and leaflets

- Providing support for smaller developers by allowing them to defer payments to local councils to ease cash flow

- The new guidance includes the permission for trades people to operate in homes, providing they follow social distancing advice.

Stewart Baseley, executive chairman of the Home Builders Federation, said: "A resumption of work will play a major part in helping the economy recover, as well as delivering the homes the country needs. It should also provide the supply chain with the confidence it needs to accelerate its own restart."

I will keep a careful watch on how the market performs over the next eight weeks. After the hiatus of the lockdown, the next few weeks’ sales performance for new home developments will dictate how confident we can be moving forward. This confidence will be influenced by potential market values and sales rates. I will be keeping up to date with market conditions and changes as the picture develops.

All measures of sales market activity continue to improve as pent-up demand returns to the housing market. Buyer demand is 11% higher than a year ago. A better indicator of market health is sales agreed which are 15% higher than a year ago – evidence of greater buyer confidence and more realism on pricing by sellers. The North East (+17%) and London (+16%) have led the rebound in sales.

Sales hold up in Q4 2023, providing support for prices

The final weeks of 2023 have recorded above average levels of new sales, 17% higher than a year ago and ahead of 2019 levels. Market sentiment is improving due to rising incomes and an initial decline in mortgage rates. An increase in available supply, up a quarter on last year, is also boosting choice and supporting sales.

Affordability and value for money will be the big key drivers for the housing market in 2023. These two factors are going to flip the flight to rural and coastal areas, which has dominated the housing market in recent years, into reverse. Instead, apartments and urban areas, which lost some of their popularity during the pandemic as the nation began the search for more space in idyllic locations, are making a comeback.

January 4, 2022- back to work and some sense of “normality”. I expect like so many of us we have all had our festive arrangements changed by the dreaded “Omicron” over the past few weeks, although hopefully we can all get back in front of our laptops, keep looking ahead and get on with what hopes to be a more promising and positive year ahead.

MPs have backed setting the cost of ground rents on new houses in England and Wales at "one peppercorn" a year. The government-sponsored plan, if it becomes law, will effectively leave owners who buy only leases - rather than freeholds - paying nothing. The move follows concerns that leaseholders are being charged exorbitant, fast-rising ground rents