Zoopla Report - UK House Price Index – February 2024

"The housing market has proved very resilient to higher mortgage rates and cost of living pressures. More sales and more sellers shows growing confidence amongst households and evidence that 4-5% mortgage rates are not a barrier to improving market conditions"

Richard Donnell Zoopla's Executive Director - Research

Sales market activity continues to improve

All measures of sales market activity continue to improve as pent-up demand returns to the housing market. Buyer demand is 11% higher than a year ago. A better indicator of market health is sales agreed which are 15% higher than a year ago - evidence of greater buyer confidence and more realism on pricing by sellers. The North East (+17%) and London (+16%) have led the rebound in sales.

Growing confidence amongst sellers is boosting the number of homes for sale, which are 21% higher than a year ago. More supply is increasing choice for would-be buyers and supporting sales.

While increased activity levels are welcome news, it's important to note that a small proportion of sellers continue to reduce asking prices to attract buyer interest. Asking price reductions are lower than a year ago but remain above average, evidence of continued price sensitivity amongst buyers. Asking price reductions of 5% or more are greatest in the South East and East of England.

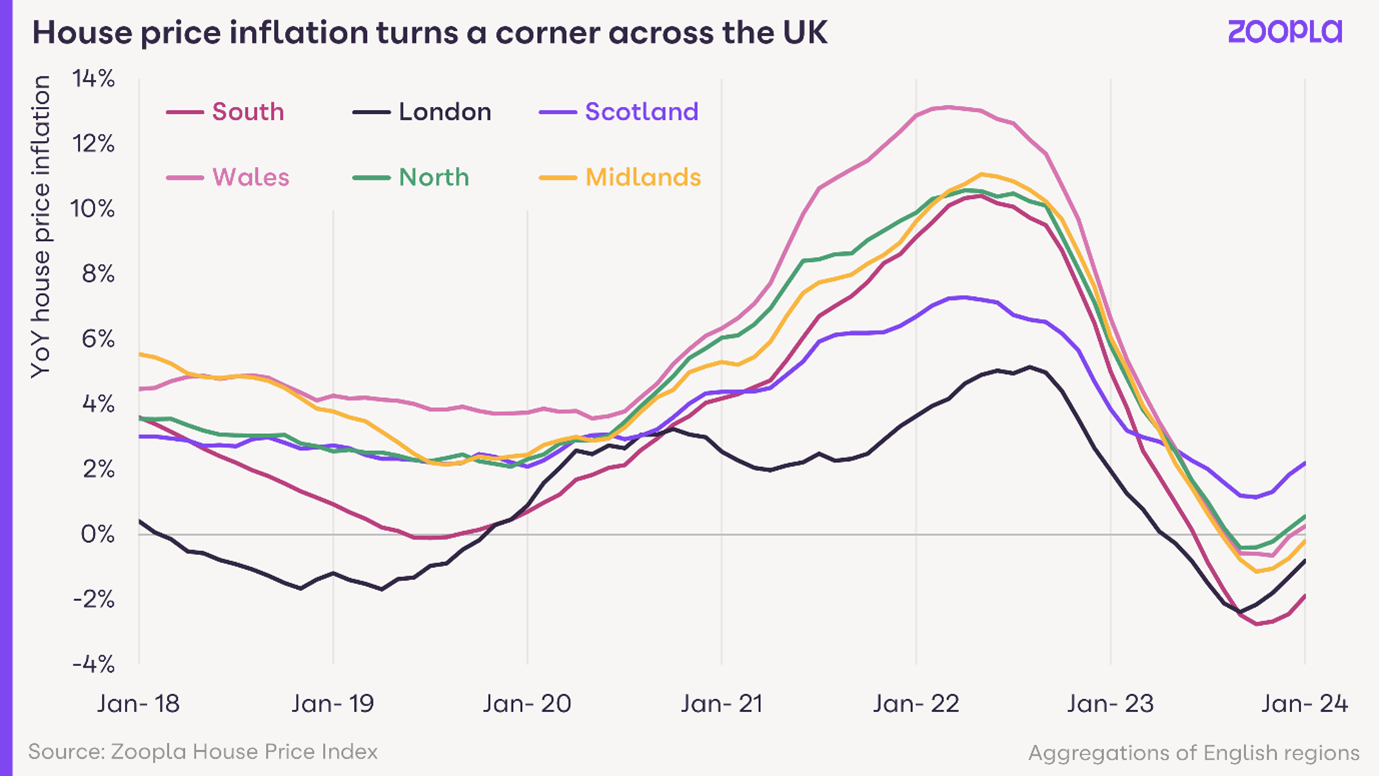

The average estate agent is agreeing 6 new sales a month, up from 5.2 a year ago. This is evidence that house prices don't need to fall to support growing sales volumes. This is feeding through into our UK house price index, which continues to record a slowdown in the rate price falls. Annual house price inflation is currently -0.5%, up from the recent low of -1.4% recorded in October 2023. The average UK house price is 1.5% below the peak of £268,000 in October 2022.

Slowing price falls is a trend being recorded across all regions and countries of the UK. Five southern English regions are registering annual price falls of up to -2.1%, led by the East of England. House price inflation has moved into positive territory in the remaining 4 regions of England in addition to Wales, Scotland and Northern Ireland, where annual price inflation is 4.3%.

A three-speed housing market

Higher mortgage rates and cost of living pressures have driven a rapid slowdown in the rate of house price inflation over the last 18 months. There are some notable variations in price inflation across the country which are primarily explained by the relative affordability of housing.

Current housing trends fall into one of three groups.

1) Southern England regions - covering East of England, South East and South West regions, these areas have registered the largest annual price falls. Rising mortgage rates and reduced household buying power have hit higher-priced markets harder than more affordable markets. Average home prices are £344,000 in these areas, 30% above the UK average. The pace of price falls is starting to moderate in Southern England, but it's lagging other areas of the UK.

2) London - we see London differently to the rest of southern England. While it is the most expensive housing market, with an average price of £534,000. almost 2x the UK average. However, weak house price inflation over the last seven years has improved affordability and opening the market up to more potential buyers than before.

The rebound in demand and low growth in the supply of homes for sale (just 7% in London vs 21% for the UK) explains why house price inflation is rebounding quicker than the southern England regions.

3) Rest of the UK - while house price growth has slowed rapidly over the last 12 months, annual price falls have been very limited across the rest of the UK where average house prices are 28% below the UK level. This explains why the impact on buying power from higher mortgage rates outside Southern England has been less pronounced.

Our index shows Scottish house prices remaining in positive territory over the whole of the last year. Northern regions of England, the West Midlands and Wales are registering firmer pricing in response to rising sales agreed and better levels of housing affordability.

NeMortgage rates fall but remain above 4%

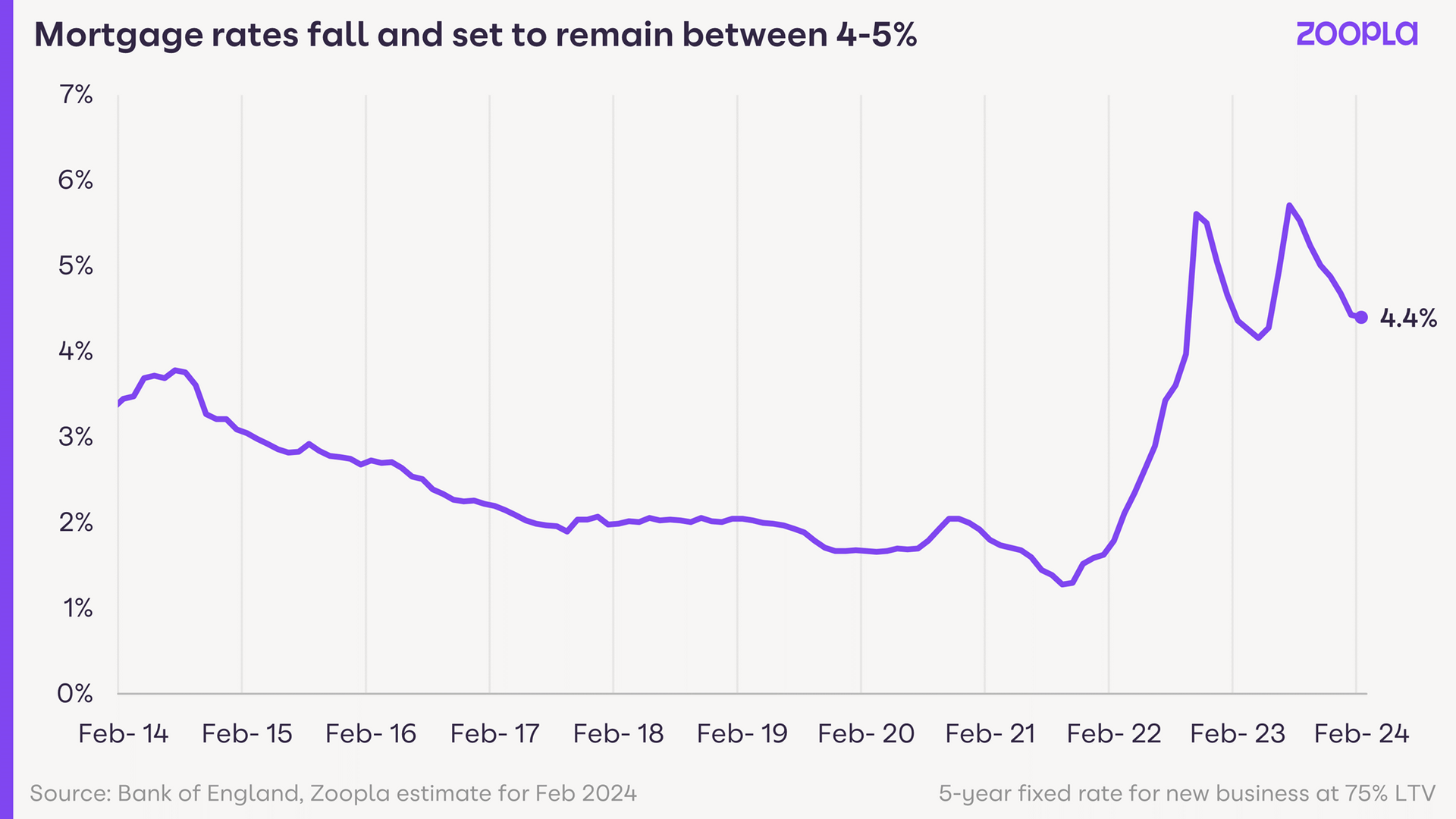

Falling mortgage rates have been an important catalyst for improving market sentiment and increased levels of housing market activity in recent weeks. Faster earnings growth and rising incomes are also starting to offset the impact of higher borrowing costs, albeit slowly.

Mortgage rates have fallen back to where they were a year ago. This recent decline is likely to plateau at the current levels. Lenders have been pulling mortgage deals below 4% as the cost of finance used to fund mortgages has increased modestly in recent weeks.

Buyers should anticipate 4-5% mortgage rates over much of 2024. Our consistently held view is that 5% mortgage rates are the tipping point for annual house price falls. Mortgage rates over 6% for a sustained period would lead to larger double-digit price falls. Mortgage rates in the 4-5% range are consistent with flat to low single digit price rises.w Paragraph

The outlook - sales more likely to rise than house prices

There is clear demand from homeowners and first-time buyers looking to move and buy their first home in 2024. This is going to support higher sales volumes, but we don’t expect higher house price growth.

The reality is that the housing market is still adjusting to higher mortgage rates and the impact of reduced buying power, the impact of which has varied across the country. Sellers need to remain realistic on pricing and celebrate the fact that their home is likely to attract more buyer interest, increasing the chances of a agreeing a sale. Mortgage rates could move a little lower over the year, but this hinges on the timing of future base rate cuts, which may come later this year.

Sales market momentum has been building over the last five months. We believe that the market is on track for 10% more sales in 2024 than last year, set to total 1.1m. More supply is boosting the potential for growth in sales. It is important, however, that sellers don’t start expecting more for their homes.

Comments from Martin

It is pleasing to see that overall this report makes positive reading.

Although many younger people are struggling with the thought of a 5% mortgage interest rate, for those of us over 50, we will remember the pain of interest rates being 13-15% was the norm - yet he market bounced back!

I realise that times are very different now in relation to the amount of deposit required and the earnings to borrowing ratios, but overall the market remains strong .

If we can get past this election year and either this one or a new Government will take on some of the planning issues and backlog of approvals, we should all definitely feel happier.

It would be great to hear your own experiences in the markets local to where you are building. Please get in touch.

Martin