What are the housing market predictions for 2023?

Happy New Year!

I found this article on Zoopla written by Nic Hopkirk on 22 December 2022, and thought some of the insights were very interesting. Although some of the highlighted towns and cities are further North than some of you build in, the mention of Swindon, supports findings that I am already aware of.

Key takeaways

- ·Tide turns on the desire for coastal and rural areas as demand for affordable cities and apartments rises

- Buyers once again attracted to urban settings with plenty of jobs and services

- The dynamics that have shaped the housing market over the last 5 years are shifting

Affordability and value for money will be the big key drivers for the housing market in 2023. These two factors are going to flip the flight to rural and coastal areas, which has dominated the housing market in recent years, into reverse. Instead, apartments and urban areas, which lost some of their popularity during the pandemic as the nation began the search for more space in idyllic locations, are making a comeback.

Zoopla’s Executive Director for Research, Richard Donnell says “The dynamics that have shaped the housing market over the last 5 years are shifting. We expect affordable urban centres to fare better than average in 2023 but the inner London market may require another year before it is ready to rebound.”

Why are urban areas becoming popular again?

Influenced by higher mortgage rates, household incomes and the actual level of house prices, buyers are being priced out of the more expensive markets, preferring to look in areas where homes are more affordable.

Increasingly keen to secure homes in urban settings, where jobs are being created and more services are available, buyers are now showing a stronger preference for towns and cities. The popularity of family homes in city suburbs and commuter areas is also rising, with demand for homes in these areas climbing to above average levels over the last year.

How rising mortgage rates are affecting where buyers choose to live

Mortgages are currently needed for seven out of every 10 home purchases.

Higher mortgage rates are currently affecting what many people can afford to buy, as they mean more income is needed to secure a sale. The more expensive a market, the greater the number of households that are priced out.

This in turn weakens demand, leading to fewer sales and possible price reductions to secure those sales in these areas. In affordable markets with lower average house prices, the opposite is true.

Why affordable markets will fare better in 2023

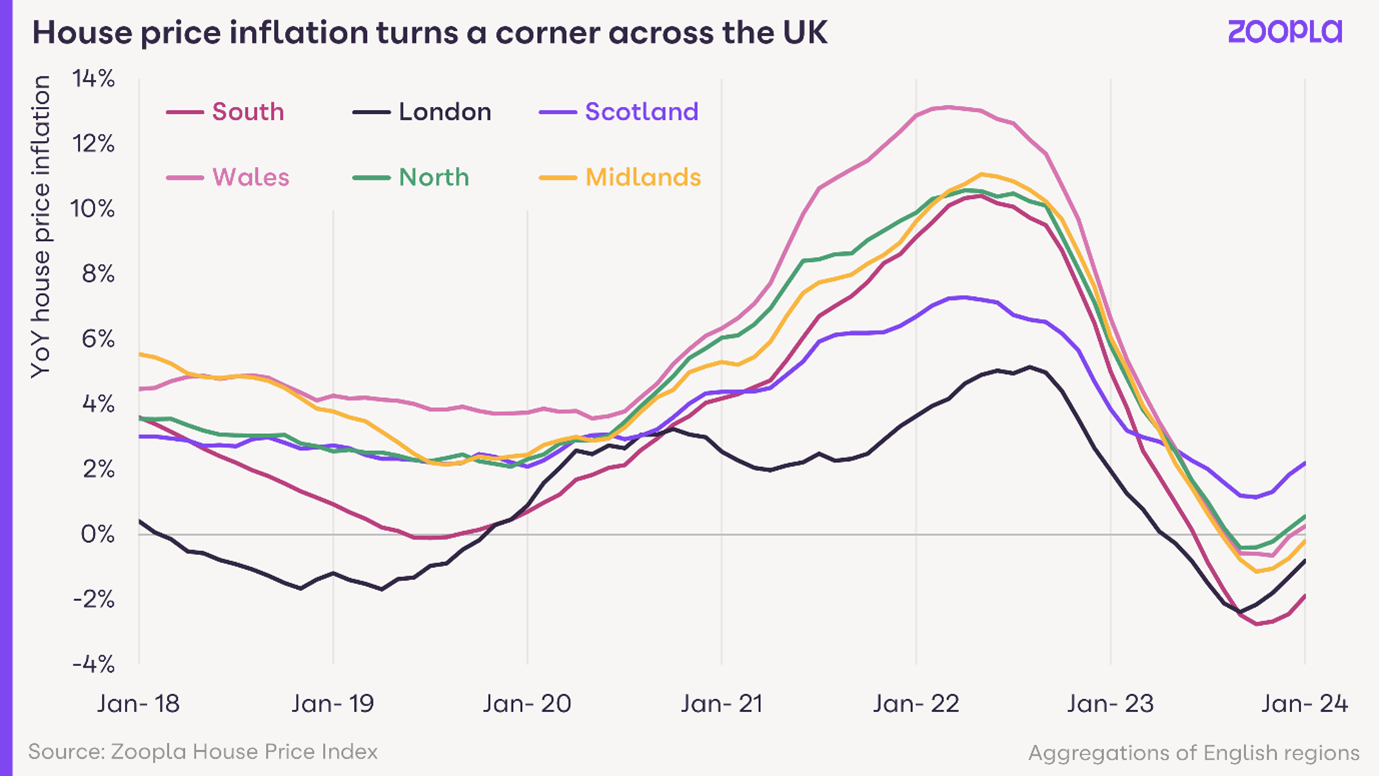

As demand for more affordable areas increases in 2023, these markets are likely to fare better than their more expensive counterparts in terms of price falls over the coming months. Most housing markets have recorded house price gains of 25.4% over the last 5 years. That's above the level of consumer price inflation (+19%) and average earnings (+22%) over the same time period. Economic growth, good affordability and low mortgage rates have all enabled above average price gains over this period.

The Oldham postal area recorded the highest price increases since 2017 at +47%, while Newport, Swansea and Bolton also enjoyed high value gains. However, we expect house price growth to slow in these higher-growth markets in 2023. UK house prices are predicted to fall by an average of 5% next year.

But in the more affordable markets, the falls are likely to be lower, as the hit to buying power from higher mortgage rates will be felt less keenly.

Which affordable cities are buyers interested in?

Major towns and cities, including Bradford, Swindon, Coventry, Crewe, Milton Keynes and Southend are all registering above-average demand. These areas all have their own employment base, but they also enjoy good transport connections into much larger employment centres, such as London, Leeds, Manchester and Birmingham.

We believe employment growth will continue to stimulate housing demand in these affordable city regions throughout 2023.

Why flats are becoming better value for money

Apartments make up around 1 in 5 homes in the UK, but price inflation for them has lagged behind the growth enjoyed by houses. Across the UK, houses are currently valued at just over twice the price of flats. That’s the highest price difference seen for 20 years. Flats haven’t experienced those same value gains as houses partly because the search for space made them a less popular option during the pandemic, but also because buyers were experiencing concerns over cladding and leasehold charges.

However, we expect demand for flats to increase throughout 2023, as buyers seek better value for money.

The government’s moves to ensure cladding problems are remediated in most buildings will also help to boost their popularity further.

If you would like to discuss or price any sites or potential developments, please give me a call on 07973 886609.