Now is a Great Time to Review and Update Your Marketing Strategy

April 29, 2020

Websites, Digital and Estate Agents

Whilst we are in this period of enforced “lockdown” it gives business owners time to look at all those areas of the business that are on the to-do-lists for far too long.

In a recent Zoopla article, they state that some 373,000 property sales are on hold owing to the coronavirus lockdown, analysis of the housing market in UK cities suggests. The value of held sales totals a collective £82bn.

Agreed sales were running at a tenth of the normal level for the time of year and were akin to the activity seen in late December, they said.

Spring is usually a busy time for the housing and mortgage markets. It is known in the trade as the "spring bounce". However, the stay-at-home message from the government has meant that people are only moving to new homes in rare circumstances, such as entering a vacant property.

Government advice is for sellers and buyers to come to an amicable arrangement over delaying a moving date. The Zoopla report added that demand for housing was down 60% on levels recorded at the start of March. However, the picture varied across UK cities, with Cardiff recording an 80% drop in demand from buyers, and Newcastle a 48% fall. The housing market could take some time to recover

"Some may feel the urge to move and find more space or consider the potential for remote working," said Richard Donnell, director of research and insight at Zoopla. "This could boost activity in the second half of 2020, but this all depends upon how much the economy is impacted over the rest of the year and the impact on levels of unemployment."

Overall, Zoopla expects the number of completed sales across the UK this year to be around half that seen in 2019.

Making the most of the additional time on our hands.

Websites

- Have you had a really detailed look at your website recently?

- Is it fully responsive i.e. have you looked at it on a PC/Mac, phone and tablet?

- Is it up to date with all your current/future developments?

- Do all the links work?

- Do all your photos have alt text?

- Are your brochure easily accessible and easy to open?

- When did you last review the SEO behind every page?

- Are you happy with the navigation- can you find your way back to the navigation sections easily?

Social Media Platforms

- What is your level of Social Media exposure?

- Basics should include Facebook, Twitter, LinkedIn and Instagram.

- Have you considered a Blog?

- How frequently do you post on your Social Media?

Relationships with Estate Agents

- Are you satisfied with the level of service and Sales you receive?

- Are the key members of staff the ones you want to deal with?

- Are you happy with the site staff?

- How often do you “Mystery Shop” the agents either by phone or site visits?

Marketing Material and Signage

- When did you last review the style and format of your brochures?

- Is your digital offer as strong as your hard copy information?

- Have you looked at the competition’s material?

- Is your signage updated, clear and has a call to action?

If you have any queries or would like to discuss any marketing issues or any problems relating to your Agents of Sales staff please give me a call on 07973 886609.

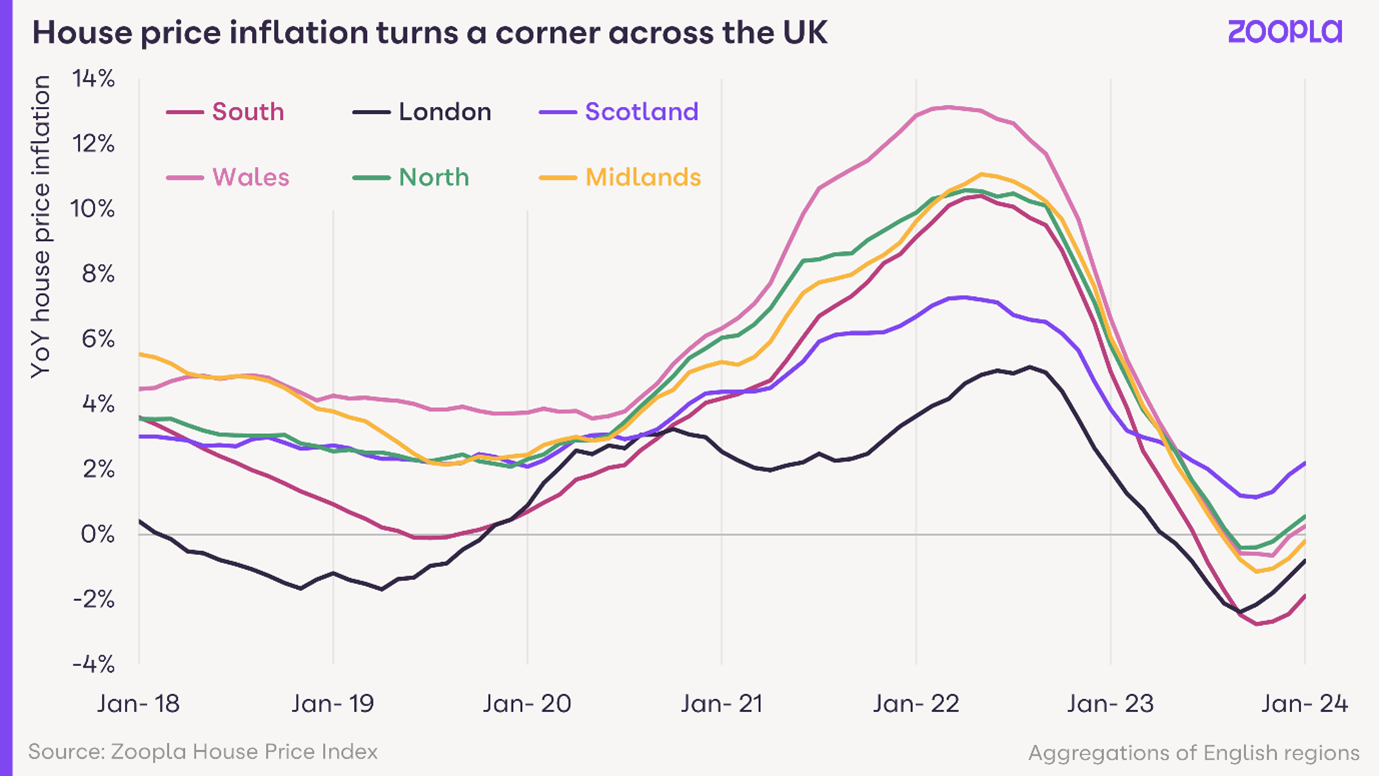

All measures of sales market activity continue to improve as pent-up demand returns to the housing market. Buyer demand is 11% higher than a year ago. A better indicator of market health is sales agreed which are 15% higher than a year ago – evidence of greater buyer confidence and more realism on pricing by sellers. The North East (+17%) and London (+16%) have led the rebound in sales.

Sales hold up in Q4 2023, providing support for prices

The final weeks of 2023 have recorded above average levels of new sales, 17% higher than a year ago and ahead of 2019 levels. Market sentiment is improving due to rising incomes and an initial decline in mortgage rates. An increase in available supply, up a quarter on last year, is also boosting choice and supporting sales.

Affordability and value for money will be the big key drivers for the housing market in 2023. These two factors are going to flip the flight to rural and coastal areas, which has dominated the housing market in recent years, into reverse. Instead, apartments and urban areas, which lost some of their popularity during the pandemic as the nation began the search for more space in idyllic locations, are making a comeback.

January 4, 2022- back to work and some sense of “normality”. I expect like so many of us we have all had our festive arrangements changed by the dreaded “Omicron” over the past few weeks, although hopefully we can all get back in front of our laptops, keep looking ahead and get on with what hopes to be a more promising and positive year ahead.

MPs have backed setting the cost of ground rents on new houses in England and Wales at "one peppercorn" a year. The government-sponsored plan, if it becomes law, will effectively leave owners who buy only leases - rather than freeholds - paying nothing. The move follows concerns that leaseholders are being charged exorbitant, fast-rising ground rents