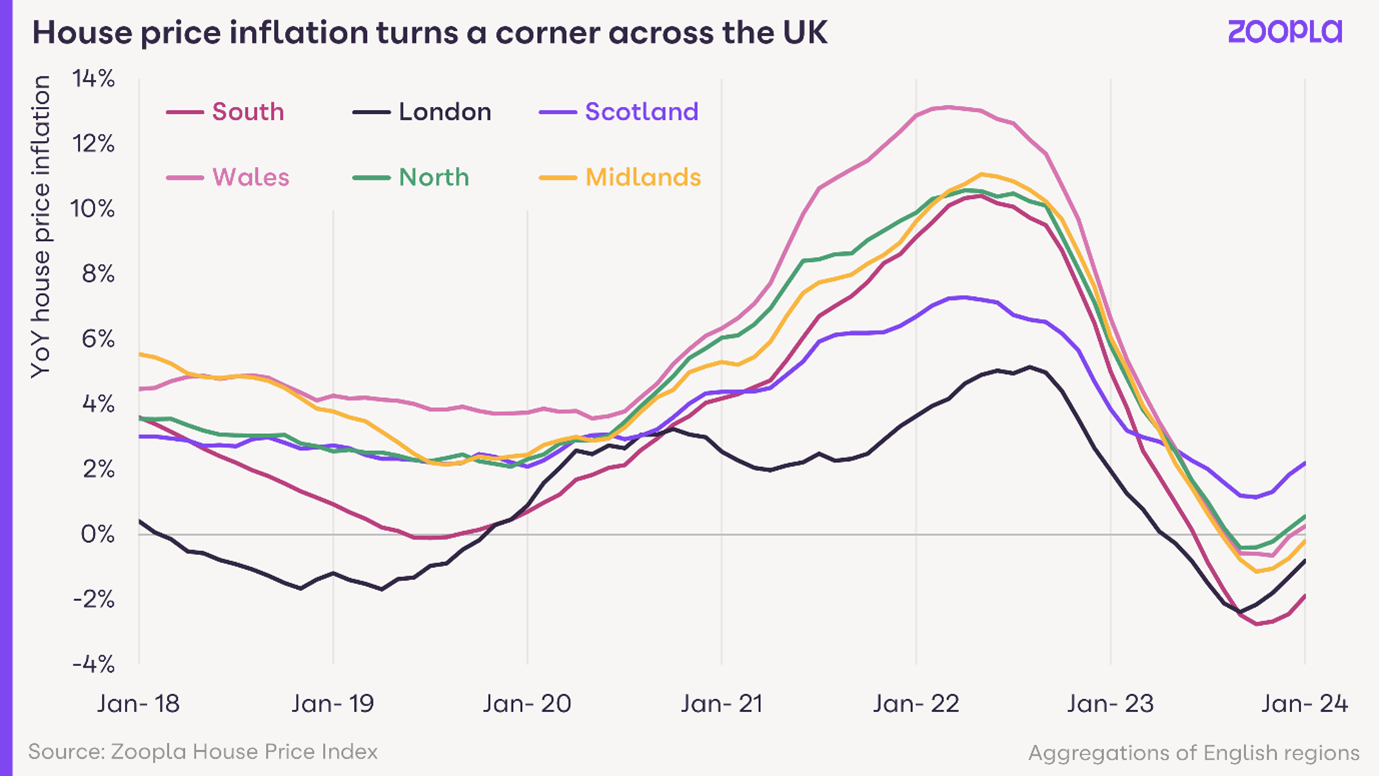

2023 Housing market and overview for 2024 – much more positive than predicted

Adapted from the Zoopla UK Price index report-December 2023

Key Takeaways

- Annual house price inflation is -1.1%, down from +7.2% a year ago

- Market sentiment improving with new sales agreed +17% year-on-year

- House price falls starting to moderate as sales improve

- Mortgage regulations a key reason for only modest price falls in 2023, along with strong labour market and rapid earnings growth

- First-time buyers are largest group of would-be movers in next 2 years (40%) followed by upsizers (34%)

- Almost half of buyers living in southern England looking to move >10 miles in search of better value for money

- House prices to fall 2% over 2024 with 1m sales

Regional figures may vary.

Sales hold up in Q4 2023, providing support for prices

The final weeks of 2023 have recorded above average levels of new sales, 17% higher than a year ago and ahead of 2019 levels. Market sentiment is improving due to rising incomes and an initial decline in mortgage rates. An increase in available supply, up a quarter on last year, is also boosting choice and supporting sales.

Buyers and sellers are becoming more aligned on pricing, reducing the downward pressure on values. Zoopla’s headline UK house price index has recorded a slower pace of annual price decline at -1.1% in November 2023, down from +7.2% a year ago. The level of price falls have now moderated across all regions and countries of the UK

Why haven’t house prices fallen by more in 2023?

History would suggest that mortgage rates rising from 2% to over 5% would have led to larger price falls than what has been recorded over 2023. There are several reasons why prices have defied predictions of larger falls. The strength of the labour market has been an important factor along with high earnings growth. Lenders have also pursued forbearance policies to support households struggling with repayments, which has limited the number of forced sellers.

But perhaps the most important factor here has been the tougher mortgage affordability testing for new borrowers since 2015. These regulations were designed to stop households taking on excessive

debt at a time of low mortgage rates. They have stopped a major housing over-valuation and built resilience for many households to manage the transition to higher mortgage rates.

While mortgage rates got as low as 1.3% in late 2021, all new mortgage borrowers had to prove to their bank they could afford a 6-7% stressed mortgage rate to get the loan. Banks were also limited to 15% of new business at high loan to income ratios over 4.5 times salary.

These regulations have effectively capped buying power for home buyers. They require the borrower to have a higher income to buy and put down a larger deposit, which is especially true in higher value housing markets.

Today lenders are stress testing new borrowers at close to 9% despite mortgage rates starting to fall. This regulatory constraint on buying power is one reason we believe house prices are unlikely to rise in 2024, even as base rates start to fall later in the year.

First-time buyers to remain largest buyer group in 2024

Despite the affordability challenges facing first-time buyers, they are the largest group of would-be buyers. Zoopla’s latest consumer survey found that 40% of people looking to buy a home in the next 2 years are first-time buyers. The rapid growth in rents continues to motivate this group - average rents have risen faster than average mortgage repayments over the last 3 years.

Upsizers account for a third of would-be buyers in the next 2 years who will typically be buying a larger home that will require a larger mortgage. This group have been biding their time in 2023 waiting for the outlook on the economy and mortgage rates to become clearer.

The trajectory for mortgage rates and getting better value for money will be key considerations for upsizers in 2024.

Outlook for 2024

Zoopla expects the steady momentum in new sales that has developed over the final part of 2023 to continue into early 2024, with the usual seasonal rebound in demand over Q1 as pent-up demand returns to the market.

While mortgage rates are edging lower, affordability remains a key challenge for mortgage-reliant households who are making home moving decisions. The impact of higher mortgage rates continues to feed through with half of mortgagees are yet to move onto higher rates from cheaper fixed rate deals agreed before 2022.

The modest decline in house prices over the year means UK housing still looks 10-15% overvalued at the end of 2023. We expect this position to improve over 2024 as incomes rise and house prices drift 2% lower over the year. Sales volumes are expected to hold steady at 1 million sales completions in 2024.

I am constantly working on all the latest data, taking into account local variations and competitor challenges on an individual site and/or location basis.

I will be delighted to look at any developments or potential opportunities that you may be considering.

Wishing you a happy, stress-free and healthy 2024.

Martin