2022 – What does the New Year have in store for us?

January 4, 2022- back to work and some sense of “normality”. I expect like so many of us we have all had our festive arrangements changed by the dreaded “Omicron” over the past few weeks, although hopefully we can all get back in front of our laptops, keep looking ahead and get on with what hopes to be a more promising and positive year ahead.

Land prices continue to be very competitive and keen developers are paying top dollar for smaller, sub 50-unit sites, despite the challenges of taking on the planning system!

Many of my clients are not only asking me for new acquisitions, but also, I’m being asked to reappraise existing sites in relation to mix, pricing and market opportunities.

The end of the stamp duty holiday has failed to dampen demand from potential buyers, which is up 30% on the five-year average. Thanks to the tapering-off period at the end of the holiday, the anticipated ‘cliff edge’ is nowhere to be seen and the pandemic-induced boom still has further to run.

According to Zoopla, an estimated 1.5 million homes are expected to have changed hands in 2021, beating 2007’s previous record. The combination of a nation re-evaluating what they want from a home, low mortgage rates and the stamp duty holiday have all driven unprecedented levels of demand.

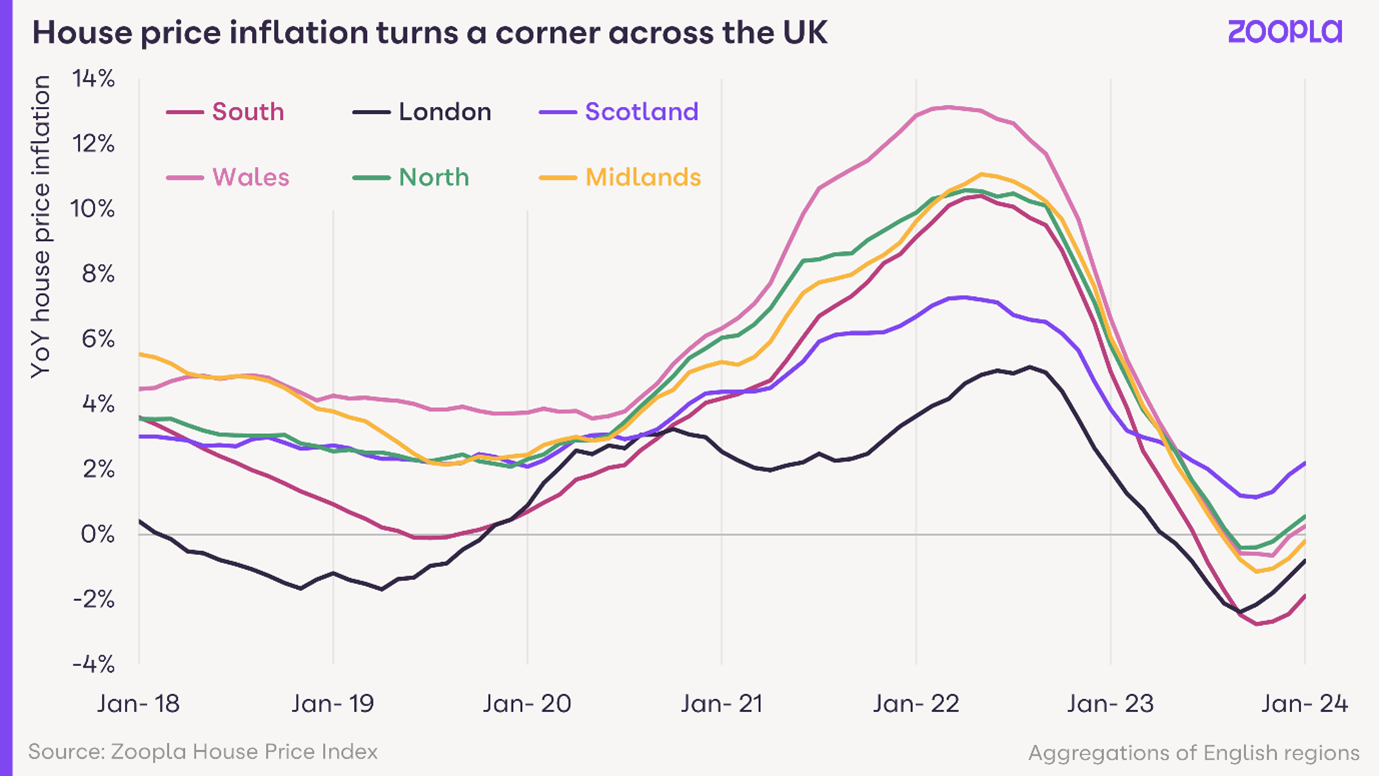

Homes collectively worth £473 billion will be sold this year, that’s up £95 billion on the number of offers accepted in 2020. However, the level of activity is expected to slow next year as the market faces a number of headwinds Annual house price growth was running at 6.6% at the end of September, but this headline figure masks significant regional variations. Price growth continues to be strongest in regions where property remains affordable, with Wales seeing the strongest gains of 10.4%, followed by the North West At the other end of the spectrum, London, where the typical property costs 11.5 times average earnings, recorded price growth of just 2.3%.

Moving into 2022, the housing market will be influenced by both positive and negative factors. On the positive side, the pandemic-induced search for space has further to run. The ability to work from home has expanded the horizons for many office workers who now feel able to look further afield. Zoopla HPI research shows that 22% of people currently want to move, significantly higher than the usual 5% in a normal market. The high levels of equity homeowners have built up during the past 18 months and the shortage of homes on the market is expected to support house price growth well into 2022.

But on the downside, the rising cost of living, combined with an expectation that mortgage rates and taxes will rise next year, will impact affordability. House price growth is expected to end 2022 at 3%, with growth likely to be strongest in the East Midlands and Northwest and weakest in London. Transaction levels are expected to fall by 20% to 1.2 million.

The bottom line is that business looks very positive for developers, but it is vital that we all stay acutely aware of what is happening in specific localities and need to keep abreast of any local market influences, competitor actions and future opportunities.

Since I am covering a wider area now for my own consultancy work, I am happy to work with clients in the whole of the southwest, Wales, West and East Midlands, M4 corridor, south coast and home counties.

I wish you a very successful 2022 and on a personal level, a happy and healthy New Year!

Kindest Regards

Martin Blake