Positive indicators as the housing market opens up

June 1, 2020

Adapted from a Property Eye Article June 1 2020

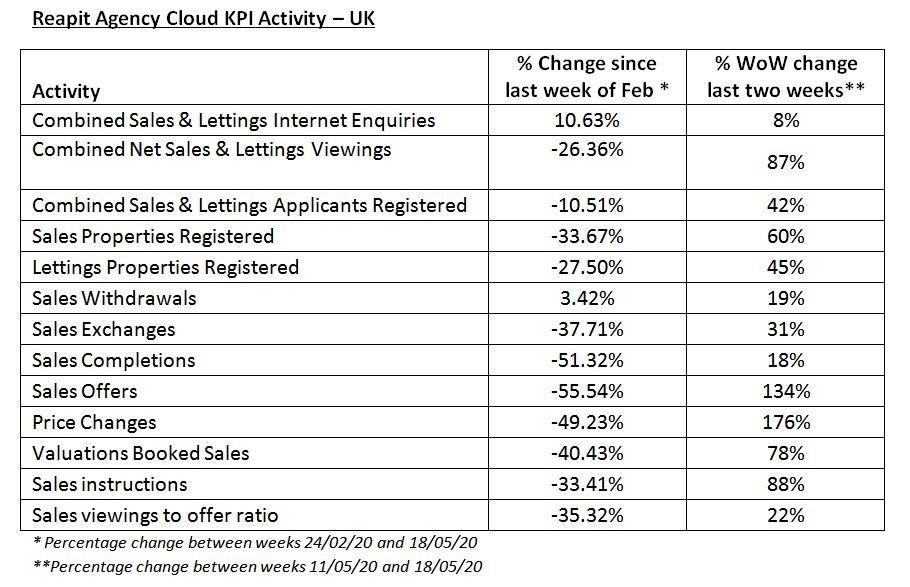

As the housing market quickly shifts gears out of lockdown, Reapit has released a dataset covering 13 weeks of KPI activity on their Agency Cloud platform up until the penultimate week of May. The data show a number of interesting trends that represent a very positive barometer for market recovery and growth.

From the last week of February (Pre-Covid) the data reveal a drop across the board on key indices which plateaued by the end of the month as the lockdown came into effect on 23 March. Tracking the data further across sales and lettings from end-February to end-May demonstrates an expected decline in activity across all activity streams, but as seen in the positive week-on-week percentage change, recovery is in the wings.

Combined net viewings for sales and lettings are now only -26.36% below pre-Covid levels, whilst combined applicants’ registrations only have another 10.51% to go before recovering to February numbers. Reassuringly, combined internet enquiries for sales and lettings are 10.63% higher than what was seen at end-February.

An overall positive upturn in growth once restrictions were lifted on 13 May is revealed in the following two weeks, with combined net viewings for sales and lettings increasing by 87%, combined applicants registered increasing by 42%, and combined internet enquiries increasing by 8%.

Sales offers, valuations and instructions data also show a strong recovery over the last two weeks of recorded data as buyers and sellers return to the market. Instructions rose by 88%, valuations are up 78%, and sales offers are back to two-thirds of pre-lockdown levels. How many of these new instructions relate to prior Covid valuations is uncertain, but early indications are that there is a positive return to the housing market.

The sales pipeline is probably one of the most interesting aspects that has been monitored and that is showing resilience, with only a drop of 6.6% of pipeline units pre-Covid. In terms of lettings, there is an overall 15% increase in rent collection portfolios, indicating many landlords moving the collection of rent to the agents to manage.

hN.B. The Price Changes percentage reflects the percentage of properties in the Reapit system on which there was a price fluctuation. It is not the percentage size of the actual price differences. Reapit is not alone in noting this upward trajectory in consumer demand. PropTech firm Coadjute recently revealed a 24% jump in listings just prior to the loosening of restrictions. The portals OneDome and Nethouseprices, both part of OneDome Group, say that they’re processing up to 4 leads a minute – up from 3 leads per minute in March and 1.7 in January.

Rightmove reported over 6 million visits to its site on May 27th, and previously commented in the wake of the market reopening two weeks ago that enquiries sent to agents by the portal were up 70% within the first four hours of agencies returning to business, with the upward trend already rising before the lockdown was lifted..

I have been working on market and valuation updates throughout the lockdown period. As from June 1, full appraisals can be available for sites and development opportunities in England.

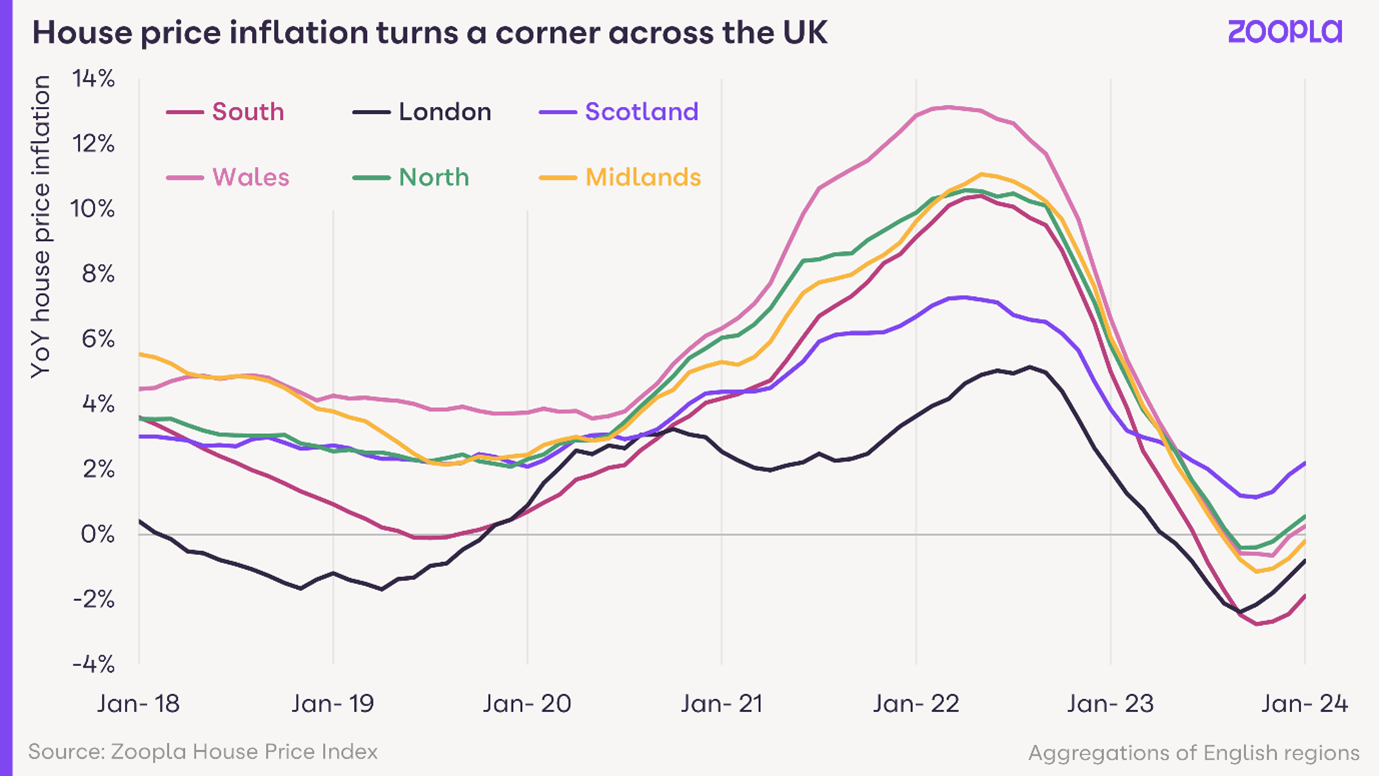

All measures of sales market activity continue to improve as pent-up demand returns to the housing market. Buyer demand is 11% higher than a year ago. A better indicator of market health is sales agreed which are 15% higher than a year ago – evidence of greater buyer confidence and more realism on pricing by sellers. The North East (+17%) and London (+16%) have led the rebound in sales.

Sales hold up in Q4 2023, providing support for prices

The final weeks of 2023 have recorded above average levels of new sales, 17% higher than a year ago and ahead of 2019 levels. Market sentiment is improving due to rising incomes and an initial decline in mortgage rates. An increase in available supply, up a quarter on last year, is also boosting choice and supporting sales.

Affordability and value for money will be the big key drivers for the housing market in 2023. These two factors are going to flip the flight to rural and coastal areas, which has dominated the housing market in recent years, into reverse. Instead, apartments and urban areas, which lost some of their popularity during the pandemic as the nation began the search for more space in idyllic locations, are making a comeback.

January 4, 2022- back to work and some sense of “normality”. I expect like so many of us we have all had our festive arrangements changed by the dreaded “Omicron” over the past few weeks, although hopefully we can all get back in front of our laptops, keep looking ahead and get on with what hopes to be a more promising and positive year ahead.

MPs have backed setting the cost of ground rents on new houses in England and Wales at "one peppercorn" a year. The government-sponsored plan, if it becomes law, will effectively leave owners who buy only leases - rather than freeholds - paying nothing. The move follows concerns that leaseholders are being charged exorbitant, fast-rising ground rents