Demand for new build homes rockets 66%

July 4, 2020

Adapted from a Zoopla Property News team July 1, 2020

Zoopla analysis shows interest in newly built properties has bounced back to a higher level than before coronavirus struck Demand for new build homes has soared by 66% since the housing market reopened, surpassing levels seen before lockdown.

The upsurge seen in the six weeks since 13 May is a continuation of the trend recorded at the start of 2020, when the new build market enjoyed its strongest start to the year since 2016. Persimmon Homes, one of the UK’s largest home builders, has seen a massive 215% month-on-month jump in demand through Zoopla buyer leads during the past six weeks. Leads are generated by buyers requesting more information from home builders via property listings.

The recovery in the new build homes sector significantly outpaces the revival in the market for older properties, where demand is currently 46% higher than before lockdown. The surge in demand for new build properties has been particularly strong among first-time buyers, growing by 87% compared with levels during lockdown.

Alex Rose, director of New Homes at Zoopla, said: “While the industry has undergone an unprecedented period, the new homes market has shown itself to be geared towards a rapid rebound.”

Why is this happening?

The resilience of the new build market is likely to be down to two factors. On the one hand, developers are used to having to sell homes when physical viewings are not possible. Mark Cook, group sales and marketing director at Persimmon Homes, said: “Our experience in offering virtual viewings, exceptional computer-generated imagery (CGI), and understanding what it takes to sell off-plan, enabled us to sustain demand, even when the market was suspended at the height of the lockdown.”

At the same time, demand is also likely to have been supported by the fact that the Help to Buy scheme can only be used to purchase a new build property. With many lenders withdrawing their 90% and 95% loan-to-value (LTV) mortgages in the face of the pandemic, more first-time buyers in particular are likely to be turning to the scheme in a bid to get onto the property ladder. The Help to Buy initiative tops up a 5% deposit with a five-year interest-free loan worth 20% of the property’s value

Who does it affect?

The North East has seen the strongest rise in demand, with interest in new build homes soaring by 139% since lockdown was lifted. The West Midlands is not far behind with a rebound of 121%, followed by the East Midlands at 108%. Wales recorded a 74% jump in demand in the six weeks to 21 June, despite the fact the market did not reopen until 22 June. Meanwhile, Scotland recorded a 33% in demand, even though the market remained closed until 29 June.

What’s the background?

First-time buyers are often described as being the lifeblood of the housing market, so it's good news for the new build sector that demand is so strong among this group. Going forward, Rose expects the initial spike in demand for new properties seen since the housing market reopened to 'settle' as the summer progresses and sales are agreed.

“First-time buyers will no doubt uphold a level of demand, with many keen to make the most of Help to Buy, following the withdrawal of many 90% LTV mortgage products,” he says.

This research comes as Prime Minister Boris Johnson unveiled plans for more than 180,000 new affordable homes to be built. He also announced changes to the planning system to make it easier to convert commercial buildings into residential ones, and to demolish vacant buildings and use the land to build homes. Property owners will also be able to build additional space above their properties through a fast-track approvals process.

This is excellent news! Long may this level of interest continue and hopefully results in completed sales. From my viewpoint, there is plenty of activity and interest. Please contact me if I can assist with any appraisal or market research work.

All measures of sales market activity continue to improve as pent-up demand returns to the housing market. Buyer demand is 11% higher than a year ago. A better indicator of market health is sales agreed which are 15% higher than a year ago – evidence of greater buyer confidence and more realism on pricing by sellers. The North East (+17%) and London (+16%) have led the rebound in sales.

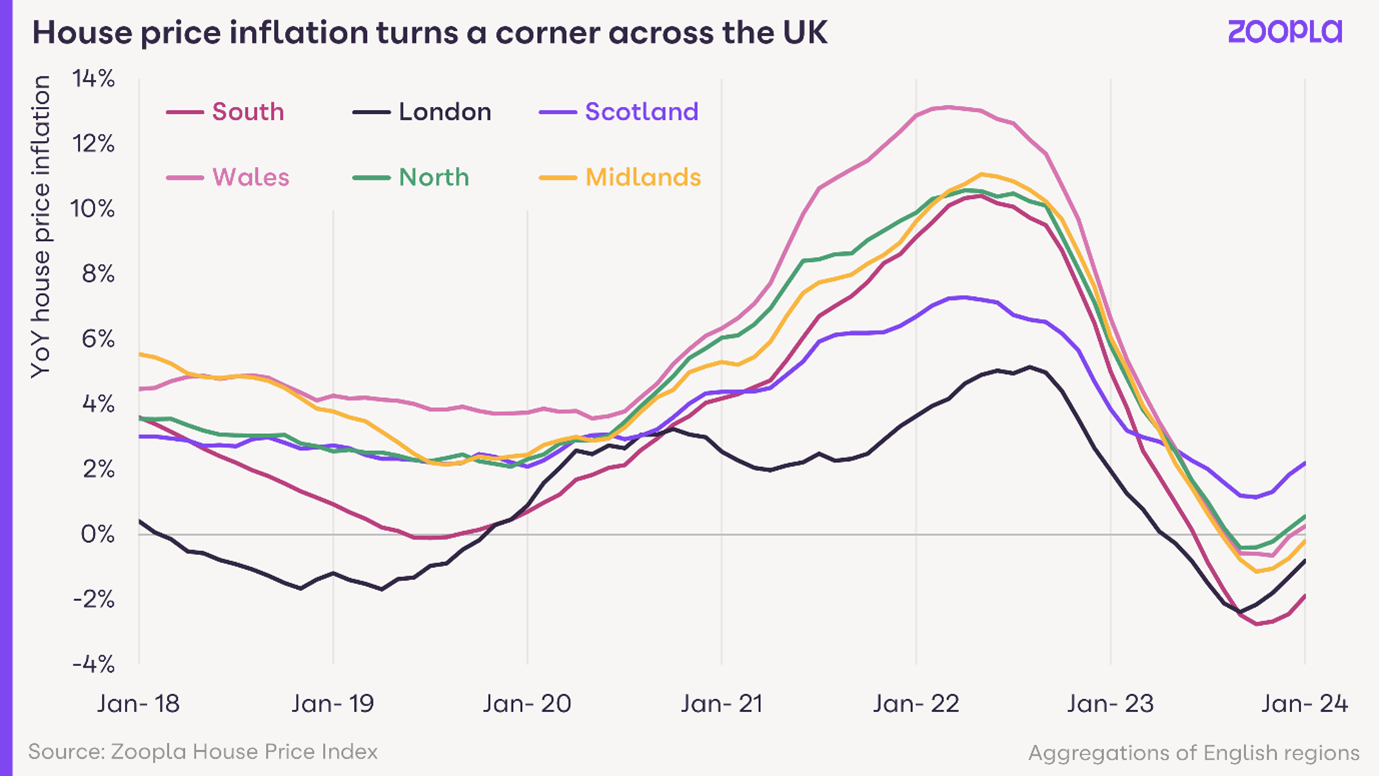

Sales hold up in Q4 2023, providing support for prices

The final weeks of 2023 have recorded above average levels of new sales, 17% higher than a year ago and ahead of 2019 levels. Market sentiment is improving due to rising incomes and an initial decline in mortgage rates. An increase in available supply, up a quarter on last year, is also boosting choice and supporting sales.

Affordability and value for money will be the big key drivers for the housing market in 2023. These two factors are going to flip the flight to rural and coastal areas, which has dominated the housing market in recent years, into reverse. Instead, apartments and urban areas, which lost some of their popularity during the pandemic as the nation began the search for more space in idyllic locations, are making a comeback.

January 4, 2022- back to work and some sense of “normality”. I expect like so many of us we have all had our festive arrangements changed by the dreaded “Omicron” over the past few weeks, although hopefully we can all get back in front of our laptops, keep looking ahead and get on with what hopes to be a more promising and positive year ahead.

MPs have backed setting the cost of ground rents on new houses in England and Wales at "one peppercorn" a year. The government-sponsored plan, if it becomes law, will effectively leave owners who buy only leases - rather than freeholds - paying nothing. The move follows concerns that leaseholders are being charged exorbitant, fast-rising ground rents