Chancellor unveils Stamp Duty holiday

July 8, 2020

Chancellor Rishi Sunak has confirmed that the Stamp Duty threshold will be increased to £500,000 immediately until March 31 next year. Sunak confirmed rumours of the Stamp Duty holiday during his summer economic update this afternoon. He said the Government will temporarily increase the nil-rate band of residential Stamp Duty in England and Northern Ireland from £125,000 to £500,000. This will apply from today (July 8th) until March 31 2021.

The Treasury said nearly nine out of ten people getting on or moving up the property ladder will pay no Stamp Duty at all. The aim is to boost the housing market and the wider economy to help the UK recover from the consequences of the coronavirus pandemic. It comes after the property market was effectively closed between the end of March and mid-May.

Agents and portals have said there has been more demand since the market reopened but it is so far unknown if this will transfer into sales. Rightmove said there are more than 510,000 properties with asking prices under £500,000 on the portal, making up 81% of all residential stock for sale in England. The property website said 291,000 properties under £500,000 are currently available for sale, making up 78% of all properties listed in England. It said people enquiring about properties under £500,000 on Rightmove makes up 84% of all buyer enquiries in England.

Mark Peck, head of residential at Cheffins estate agency, said this could provide the incentive many unsure buyers and sellers need. He said: “Whilst the market has already been significantly busy post-lockdown, cutting Stamp Duty on purchases up to £500,000 really will be the catalyst get the industry flying. The most likely impact of this measure will be a flood of buyers coming into the market who previously had sat on their hands due to political and economic uncertainty, and this flurry of activity will bring with it price rises as demand outweighs supply. He suggested it would also boost those with a low deposit as they could now increase it with the Stamp Duty savings.

How much will buyers save?

How much a buyer in England or Northern Ireland could save under the temporary measure will depend on how much the property costs – as a general rule, the more expensive the property, the more you'll save (up to the maximum of £500,000). For example, if you buy a property for £400,000 in England and you're not a first-time buyer, you would usually pay £10,000 (made up of £2,500 on the portion between £125,001 and £250,000, and £7,500 on the portion between £250,001 and £400,000). But for now, you'd pay no stamp duty on the property at all – saving you £10,000. The Chancellor has said the average saving will be £4,500.

What if I've exchanged but not completed?

The requirement to pay stamp duty is triggered when you complete the purchase of the property. So if you've exchanged prior to 8 July but not completed, you'll benefit from the increased thresholds.

Residential Rates on purchases from 8 July 2020 to 31 March 2021

If you purchase and complete on a residential property between 8 July 2020 to 31 March 2021, you only start to pay SDLT on the amount that you pay for the property above £500,000. These rates apply whether you are buying your first home or have owned property before.

You can use the table below to work out the SDLT due:

Up to £500,000 Zero

The next £425,000 (the portion from £500,001 to £925,000) 5%

The next £575,000 (the portion from £925,001 to £1.5 million) 10%

The remaining amount (the portion above £1.5 million) 12%

From 8 July 2020 to 31 March 2021 the special rules for first time buyers are replaced by the reduced rates set out above.

Higher rates for additional properties

The 3% higher rate for purchases of additional dwellings applies on top of revised standard rates above for the period 8 July 2020 to 31 March 2021.

The following rates apply:

Up to £500,000 3%

The next £425,000 (the portion from £500,001 to £925,000) 8%

The next £575,000 (the portion from £925,001 to £1.5 million) 13%

The remaining amount (the portion above £1.5 million) 15%

It will be really interesting to see the data from the property portals regarding any increase in traffic and demand. I would be really interested to hear from any agents and developers regarding enquiry levels and any client feedback.

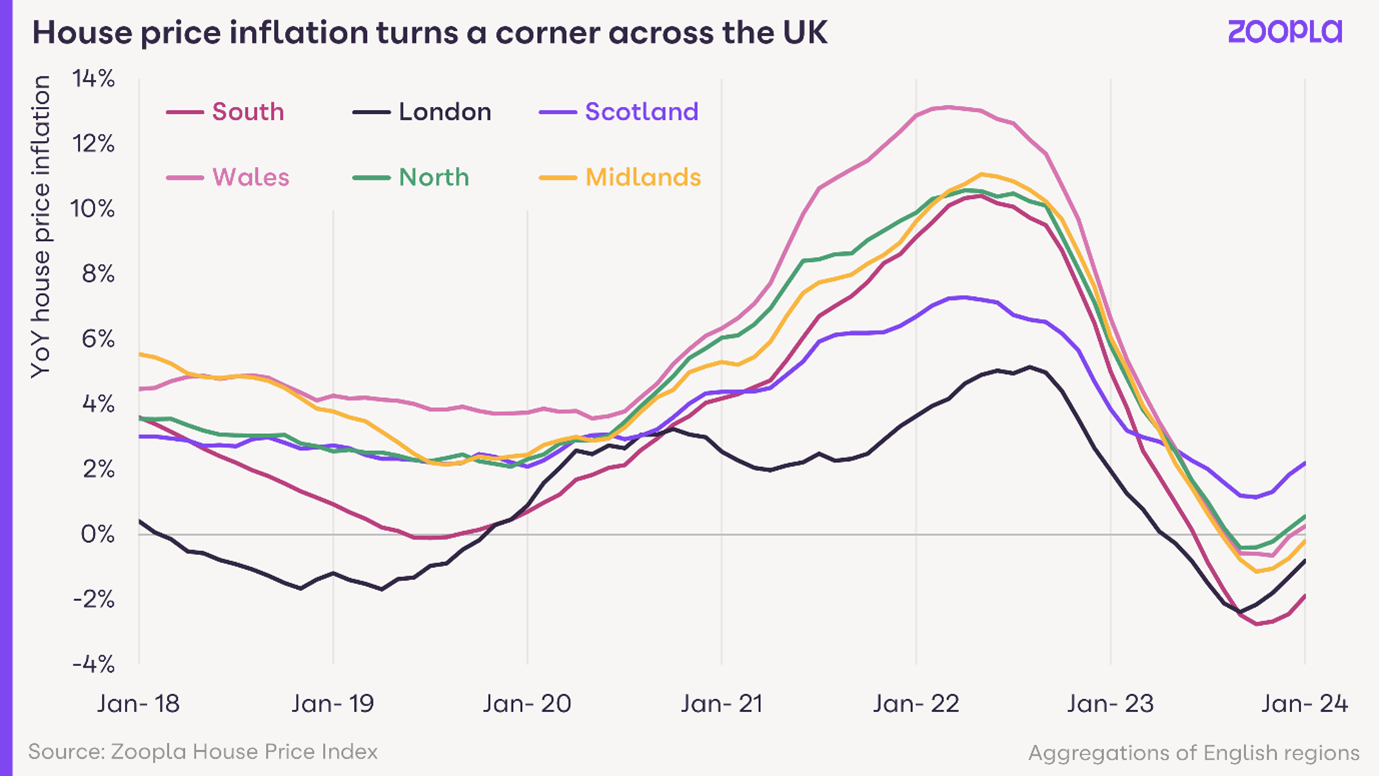

All measures of sales market activity continue to improve as pent-up demand returns to the housing market. Buyer demand is 11% higher than a year ago. A better indicator of market health is sales agreed which are 15% higher than a year ago – evidence of greater buyer confidence and more realism on pricing by sellers. The North East (+17%) and London (+16%) have led the rebound in sales.

Sales hold up in Q4 2023, providing support for prices

The final weeks of 2023 have recorded above average levels of new sales, 17% higher than a year ago and ahead of 2019 levels. Market sentiment is improving due to rising incomes and an initial decline in mortgage rates. An increase in available supply, up a quarter on last year, is also boosting choice and supporting sales.

Affordability and value for money will be the big key drivers for the housing market in 2023. These two factors are going to flip the flight to rural and coastal areas, which has dominated the housing market in recent years, into reverse. Instead, apartments and urban areas, which lost some of their popularity during the pandemic as the nation began the search for more space in idyllic locations, are making a comeback.

January 4, 2022- back to work and some sense of “normality”. I expect like so many of us we have all had our festive arrangements changed by the dreaded “Omicron” over the past few weeks, although hopefully we can all get back in front of our laptops, keep looking ahead and get on with what hopes to be a more promising and positive year ahead.

MPs have backed setting the cost of ground rents on new houses in England and Wales at "one peppercorn" a year. The government-sponsored plan, if it becomes law, will effectively leave owners who buy only leases - rather than freeholds - paying nothing. The move follows concerns that leaseholders are being charged exorbitant, fast-rising ground rents