Coronavirus and mortgage payment holidays Information

April 18, 2020

Understanding the possibility of a three-month payment break

For many the biggest financial outgoing will be your monthly mortgage payments. If you’re struggling financially due to the coronavirus crisis you may have welcomed the recent promise by the Chancellor to implement payment holidays of up to three months for those who are struggling financially.

The mortgage payment holiday will provide flexibility in repaying your mortgage by allowing you to stop or reduce your monthly payments for up to three months. This won’t be suitable for everyone but could provide much needed help if you need it, but this won’t be free money.

The first step will be to contact your lender as not everyone will be granted a payment holiday. There will be a fast track approval process in place, so you should get a quick decision although any unpaid interest will still need to be paid back, individual credit ratings should not be affected.

It’s likely the lender will spread your outstanding payments over the outstanding term of your mortgage, so you will see an increase in your monthly mortgage payments. The shorter the term left on your mortgage, the larger the increase in your monthly payments, once the mortgage payment holiday is over. You should consider the impact this will have on your future financial commitments.

It’s possible some lenders will consider increasing the length of your mortgage term to help mitigate this. In any case you should speak to your lender or mortgage adviser and ask them to provide an explanation of what this will mean for you and understand any other options which may be available to you..

The link below from the Money Advice Service is very useful www.moneyadviceservice.org.uk/en/articles/mortgage-payment-holidays#coronavirus-and-mortgage-payment-holidays

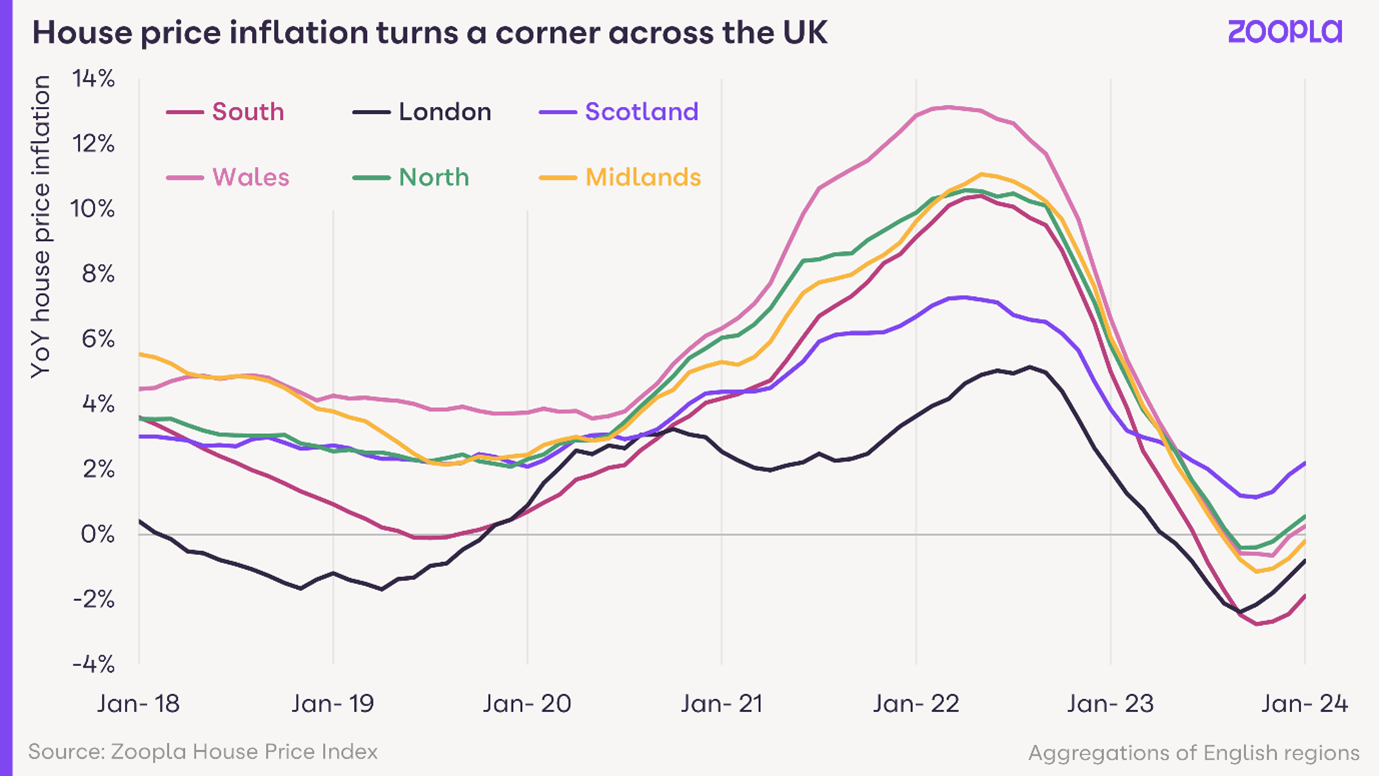

All measures of sales market activity continue to improve as pent-up demand returns to the housing market. Buyer demand is 11% higher than a year ago. A better indicator of market health is sales agreed which are 15% higher than a year ago – evidence of greater buyer confidence and more realism on pricing by sellers. The North East (+17%) and London (+16%) have led the rebound in sales.

Sales hold up in Q4 2023, providing support for prices

The final weeks of 2023 have recorded above average levels of new sales, 17% higher than a year ago and ahead of 2019 levels. Market sentiment is improving due to rising incomes and an initial decline in mortgage rates. An increase in available supply, up a quarter on last year, is also boosting choice and supporting sales.

Affordability and value for money will be the big key drivers for the housing market in 2023. These two factors are going to flip the flight to rural and coastal areas, which has dominated the housing market in recent years, into reverse. Instead, apartments and urban areas, which lost some of their popularity during the pandemic as the nation began the search for more space in idyllic locations, are making a comeback.

January 4, 2022- back to work and some sense of “normality”. I expect like so many of us we have all had our festive arrangements changed by the dreaded “Omicron” over the past few weeks, although hopefully we can all get back in front of our laptops, keep looking ahead and get on with what hopes to be a more promising and positive year ahead.

MPs have backed setting the cost of ground rents on new houses in England and Wales at "one peppercorn" a year. The government-sponsored plan, if it becomes law, will effectively leave owners who buy only leases - rather than freeholds - paying nothing. The move follows concerns that leaseholders are being charged exorbitant, fast-rising ground rents