Christmas Message from Martin Blake

Martin Blake-Symes • December 21, 2020

Oh my goodness! What a difficult and challenging year 2020 has been for everyone.

I’m very grateful that MBS Land & New Homes has successfully carried on throughout the pandemic, lockdown and all the other restrictions.

We have adapted the business, using the technologies available to us and have been doing considerably more Zoom appointments which has worked out very well for our clients in these days of social distancing and limited face-to-face visits. We have also been handling more aspects of marketing including working closely with developers regarding new websites, branding and their relationships with Estate Agents which has been positive.

The housing market has remained very buoyant although many lenders reduce the number of products that they were offering, earlier in the year and made some of the lending criteria harder. The Stamp Duty Holiday has acted as a great incentive for buyers. It will be interesting to see if this is extended by the Chancellor in the light of new Tier 4 restrictions.

I sincerely wish you and your families a much happier 2021 and hope that life returns to “normal” as soon as possible.

On behalf of myself and Caz, we wish you a Merry Christmas I look forward to working with you again over the coming months.

Kindest regards

Martin Blake

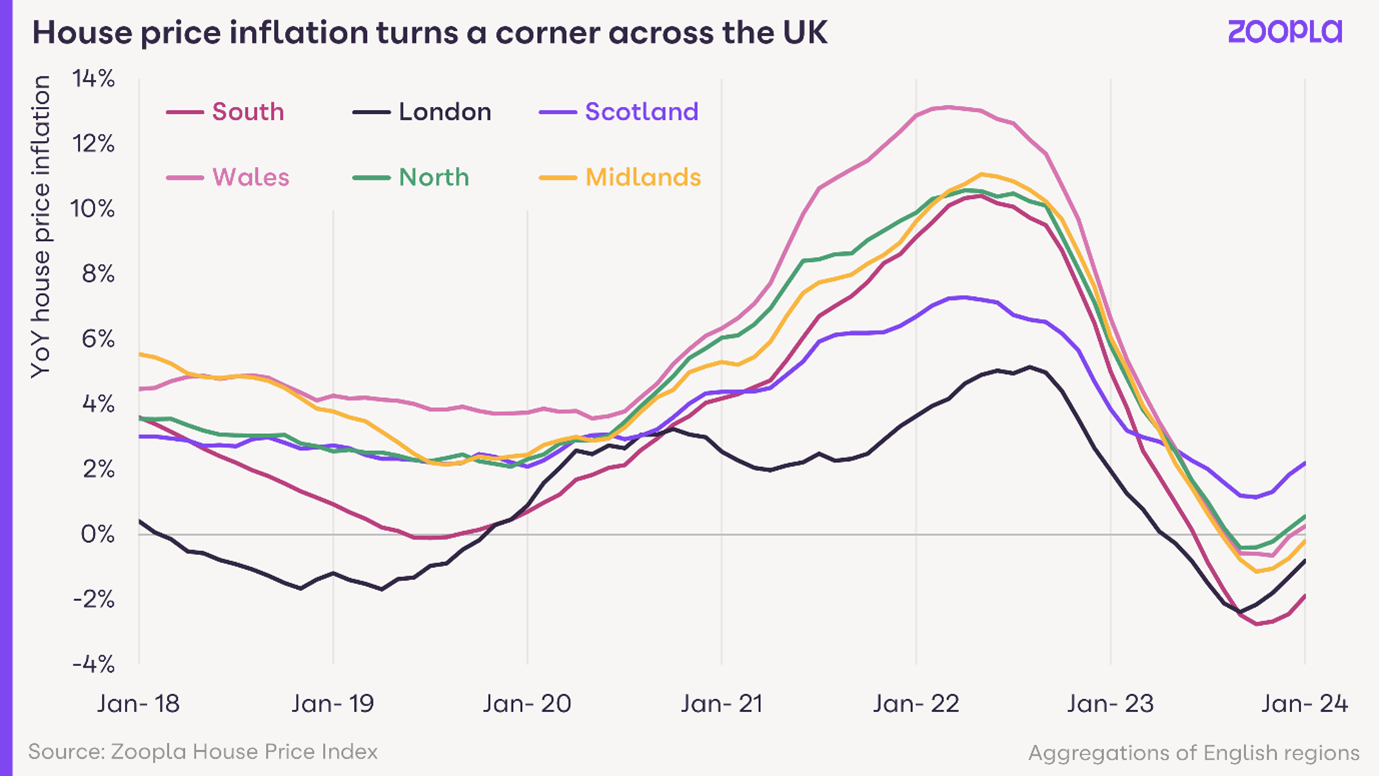

All measures of sales market activity continue to improve as pent-up demand returns to the housing market. Buyer demand is 11% higher than a year ago. A better indicator of market health is sales agreed which are 15% higher than a year ago – evidence of greater buyer confidence and more realism on pricing by sellers. The North East (+17%) and London (+16%) have led the rebound in sales.

Sales hold up in Q4 2023, providing support for prices

The final weeks of 2023 have recorded above average levels of new sales, 17% higher than a year ago and ahead of 2019 levels. Market sentiment is improving due to rising incomes and an initial decline in mortgage rates. An increase in available supply, up a quarter on last year, is also boosting choice and supporting sales.

Affordability and value for money will be the big key drivers for the housing market in 2023. These two factors are going to flip the flight to rural and coastal areas, which has dominated the housing market in recent years, into reverse. Instead, apartments and urban areas, which lost some of their popularity during the pandemic as the nation began the search for more space in idyllic locations, are making a comeback.

January 4, 2022- back to work and some sense of “normality”. I expect like so many of us we have all had our festive arrangements changed by the dreaded “Omicron” over the past few weeks, although hopefully we can all get back in front of our laptops, keep looking ahead and get on with what hopes to be a more promising and positive year ahead.

MPs have backed setting the cost of ground rents on new houses in England and Wales at "one peppercorn" a year. The government-sponsored plan, if it becomes law, will effectively leave owners who buy only leases - rather than freeholds - paying nothing. The move follows concerns that leaseholders are being charged exorbitant, fast-rising ground rents